- In UPI, the banks act as a gateway or a channel for payments, but when it comes to the digital rupee, the payments are done from one wallet to another. Here, banks don’t get involved, but it’s otherwise in the UPI.

- UPI payments are made via sources like Google Pay, PhonePe, NEFT, and RTGS, etc. In the digital rupee, the payments are done electronically.

- Settlements can be done immediately by using the digital rupee and they possess a store of value. But UPIs don’t do that as they are merely an infrastructure made to process the payments.

- In UPIs, you can’t withdraw the funds and store them in your wallet for future use. However, that’s absolutely possible in the digital rupee, making it a one-stop solution for all sorts of payments, both online and offline.

- The UPI payment system works similarly to debit cards and credit cards, whereas, the digital rupee is like a “cash form” where one can withdraw and spend or can store it like a deposit in their wallet.

- Payments made via UPI involve middlemen, hence the indirect route of transferring money. In digital rupee, the payment is done directly, and there’s no middlemen involved here.

Category: Payments

Create a free UPI payment link to receive payments from your clients.

Collect money with UPI payment apps like Bhim UPI, PhonePe, Google Pay, and others.

A free payment Gateway for India

Up to Rs 10,000 in UPI transactions will now be covered by insurance thanks to Paytm and HDFC ERGO.

One97 Communications-owned Paytm has launched a group insurance plan in partnership with HDFC ERGO General Insurance. The plan, which is called Paytm Payment Protect, will insure transactions made through UPI across all payment wallets and apps.

Paytm users can insure transactions upto Rs 10,000 by paying Rs 30 and more per annum. In addition, insurance cover for transactions costing Rs 1 lakh or above will get added on in the times to come.

The fintech company also highlighted that this plan will increase the trust of the users, enhance their digital payments experience and accelerate its adoption across the country.

According to Paytm’s Bhavesh Gupta, who is the CEO of Lending and Head of Payments, this move is meant to safeguard users and fight cybercrimes. Echoing Gupta’s point, Parthanil Ghosh, President at HDFC ERGO General Insurance’s retail business, said that while UPI and wallet payments provide ease and convenience, it makes the users susceptible to cybercrimes.

“We are excited to partner with Paytm as this asserts our pledge to provide innovative solutions to mitigate cyber risks in today’s digital era. Our comprehensive insurance offering, coupled with Paytm’s digital access, will boost digital growth and ensure financial inclusion along with protection from cyber frauds across the country,” he said.

To avail this option, users can search for the ‘Payment Protect’ option on the Paytm app. Thereafter, they can enter their name, mobile number and tap on the ‘Proceed to Pay’ button. They can also visit the HDFC ERGO website for a detailed run-through of the policies, terms and conditions, and more.

A few days back, Paytm announced Bijlee Days for all the users who pay their electricity bills from the app. The digital payments service provider said that it would be offering 100 per cent cash back and additional rewards to its users who will be making payments for electricity bills between the 10-15th of every month.

How to use UPILinks in Bhutan

How to create UPI links

- Go to upilinks.in

- Enter your name

- Enter UPI or VPA

You can find your UPI ID or VPA on your payment apps like GPay, Amazon Pay, Google Pay, Phone Pay, Paytm etc.

You can refer to the following links to find out your VPA/UPI on popular apps.

- Enter the amount of leave blank if you want the user to choose the amount.

- Choose link disposal date : If you want to terminate the payment link then select the date when it wants it to stop working. If you do not enable the disposal date then the link will be available forever.

Note: If you enter invalid UPI ID or VPA a dummy link will be generated and you will not be able to use it for payments.

UAE now accepts UPI payments from Indians.

To facilitate UPI-based payments in the Gulf country, the National Payments Corporation of India (NPCI) has teamed with the Mashreq Bank’s NEOPAY.

Travelers from India can now use UPI to pay in the UAE.

It is significant to remember that NEOPAY terminals are required in UAE stores in order for UPI payments to be accepted.

Bhutan and Nepal currently accept UPI payments.

Using UPI-based apps, Indian tourists may now easily make payments in the UAE.

Who knows how?

This is so that UPI based payments can be made in the Gulf State thanks to a partnership between the National Payments Corporation of India (NPCI) and Mashreq Banks NEOPAY.

Being able to use UPI as one of the payment options will make it significantly easier for Indian visitors to make payments in the UAE, where there is a sizable population of Indian expats.

The UPI services were first introduced in Bhutan in 2021 in association with the Royal Monetary Authority, the country’s official bank.

discussing UPI in the UAE We are happy to see BHIM UPI become live in the UAE thanks to our relationship with NEOPAY, according to Ritesh Shukla, CEO of NIPL. With the help of this initiative, Indian tourists will be able to make payments using BHIM UPI, which has become the preferred method of payment for Indian citizens. With our cutting-edge technologies, NIPL is constantly working to streamline digital payments and promote digital public goods around the world. To provide seamless user experiences when it comes to payments, we are committed to developing a sizable global acceptance network for UPI.

Best UPI Link Generator

Very few UPI link generators are available on the internet UPILinks is the best option available for you.

Here are the top features of UPILinks:

- Create a free UPI payment link to receive payments from your clients.

- Collect money with UPI payment apps like Bhim UPI, PhonePe, Google Pay, and others.

- UPILInks is a 100% free, 24-hour, government-approved method of direct payment from sender to recipient.

- Eliminating payment gateway taxes can result in annual savings of 2-3 percent of commission from each sale.

- Unrestricted ability to share links on any platform, including Instagram, Facebook, Whatsapp, SMS, websites, and much more!

Finance Ministry Clarifies That UPI Transactions will not be charged!

The central government has clarified its position in response to rumours that it could impose additional taxes on UPI payments. In a series of tweets published on Sunday, the Ministry of Finance claimed that UPI is a “digital public utility” and that there are no intentions to charge for its services. According to the tweet, the government has financially supported the country’s digital payments ecosystem. It also noted that alternative funding mechanisms must be explored to meet the expense of recovery. The ministry went on to state that it has also made plans to offer support this year to encourage more people to adopt electronic payments.

In response to rumors that UPI transactions might be charged an additional cost to support the payments infrastructure, the remark was made. The Reserve Bank of India has also asked for comments on the topic, according to a discussion paper released on August 17th. Although it wasn’t particularly addressing UPI transactions, the document covered a number of electronic payment systems, including Immediate Payment Service (IMPS), the National Electronic Funds Transfer (NEFT) system, and the Real Time Gross Settlement (RTGS) system. The report demanded that the government maintain the zero-MDR (merchant discount rate) policy, which is still in place for RuPay and UPI transactions. Service providers assert that systems can be improved by tying an MDR fee to digital payments.

The Payments Council of India (PCI), the trade group for the country’s digital payments ecosystem, requested in writing to the government that the zero-MDR policy for UPI and Rupay debit cards be reversed before the introduction of the Union Budget 2022. MDR (0.4 to 0.9%) is currently assessed on Visa and Mastercard debit cards, and it is divided between the issuer banks and acquirer. In its paper on UPI, the RBI asked for feedback on whether it should be treated differently from debit cards from Visa and Mastercard. The administration declared in the tweet that it is in favour of “economical and user-friendly” digital payments.

UPI heads to France as NPCI International and Lyra Network reach an agreement

This is NPCI International’s seventh international collaboration to spread India’s digital payment products—UPI and Rupay cards—around the world, following agreements with the UAE, Singapore, Nepal, and Bhutan.

The National Payments Corporation of India (NPCI) announced on Thursday that it has begun offering the Unified Payment Services (UPI) throughout Europe, beginning with France, following the UAE, Singapore, Nepal, and Bhutan.

The international division of NPCI, NPCI International Payments Limited (NIPL), announced during his trip to France for the Viva Technology 2022 event that NIPL had signed a Memorandum of Understanding (MoU) with Lyra Network, a provider of payment solutions based in France, to accept UPI and Rupay cards in the nation.

“The whole world is watching that India is doing 5.5 billion UPI transactions in a month. This is a big achievement for India. Today’s MoU with France is a big step towards the world,” the minister told ANI.

In May, UPI processed close to 6 billion transactions totaling Rs 10 trillion.

Unified Payments Interface (UPI), India’s leading digital payment network, has handled transactions totaling more than Rs 10 trillion in May, setting a new milestone since the platform’s debut in 2016.

Even the platform’s 5.95 billion handled transactions in May set a record high for the payments platform.

Despite a high base, the number of transactions increased by 6.63% and their value increased by 5.91% month over month. UPI processed 5.58 billion transactions totaling Rs. 9.83 trillion in April. UPI transactions have more than doubled in volume and value when compared year over year, demonstrating the rapid growth the digital payments network has experienced.

UPI processed over 46 billion transactions worth over Rs 84.17 trillion in FY22, surpassing the $1 trillion threshold. Additionally, it handled 22.28 billion transactions worth Rs. 41.03 trillion in FY21. Therefore, in a year, both the number and the value of transactions doubled. The Covid-19 pandemic, according to experts, hastened the adoption of digital payments in the nation over the past two years. UPI transactions have been increasing, tracking the recovery in the larger economy, with the exception of a few setbacks during the first two waves of the epidemic.

How to find your UPI ID/VPA in different UPI applications?

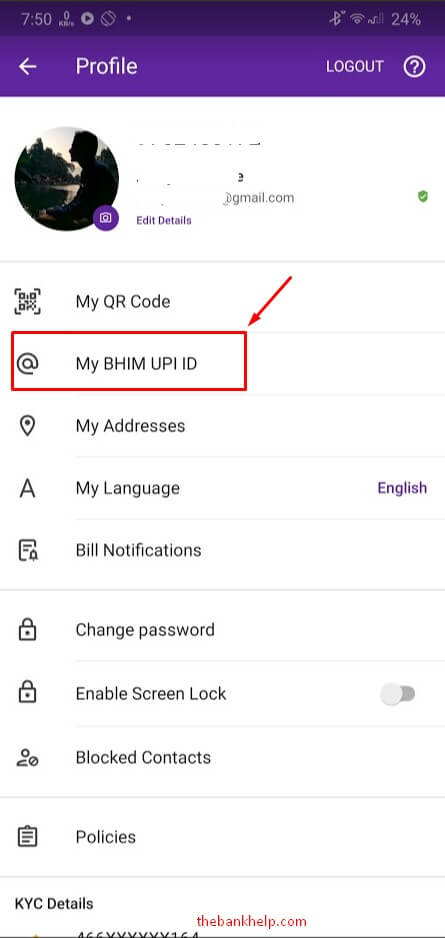

A] How to find UPI ID in PhonePe?

- Open the PhonePe app and log in with your App ID or Fingerprint authentication.

- Tap on your Profile Icon at the top left corner of the screen.

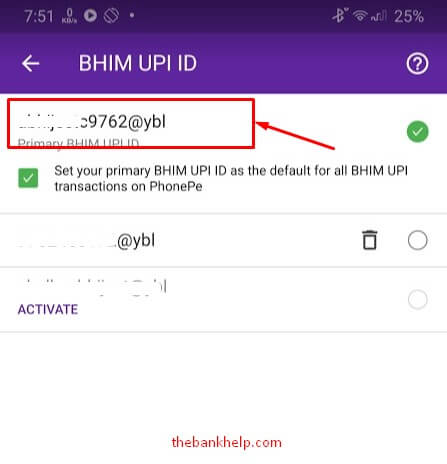

- Tap on the “My BHIM UPI ID” option from the new page.

- You can view the UPI ID associated with your bank account.

- You can Add the new UPI ID of your choice. Tap on Add new BHIM UPI ID.

- Note that you can add up to 3 UPI IDs and select any default UPI ID to receive the payments.

Must Read – UPI transaction limit per day

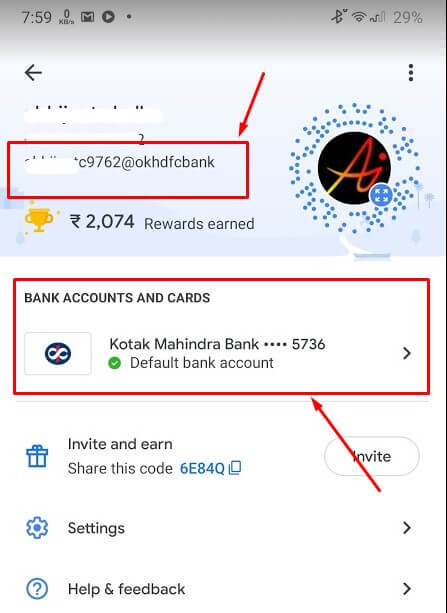

B] How to find UPI ID in Google Pay?

- Open the Google Pay app and log in with Google Passcode or Fingerprint/pattern authentication.

- Tap on your Profile Icon at the top right corner.

- On the screen, you can view the Google Pay UPI ID and the default bank added in the app.

- To change the UPI ID, tap on the bank account you want to change UPI ID and then tap on the Edit icon.

- You can now select the Handler you want to use. Select from @okhdfcbank, @okicici, @oksbi, @okaxis.

- Note that you can only change the handler and cannot change the ID before the handler.

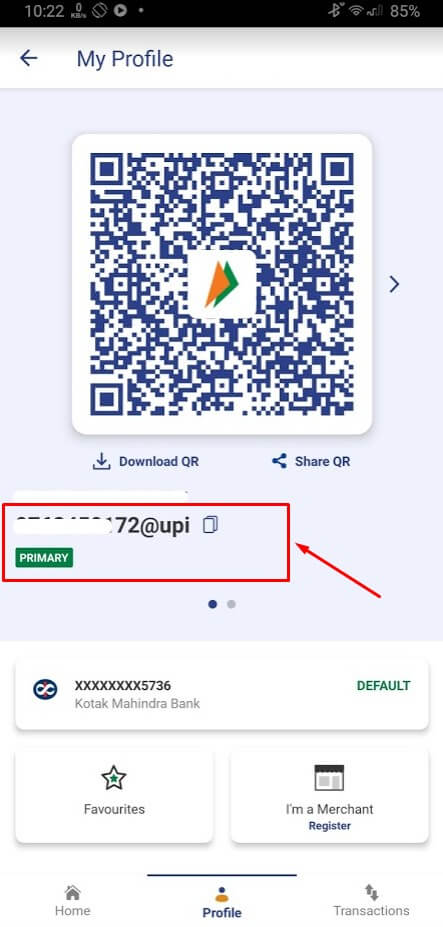

C] How to find UPI ID in BHIM App?

- Open the BHIM app on your smartphone and log in with 4 digit App passcode.

- From the Main Screen, tap on the Profile option from the bottom menu.

- You can now view your UPI ID on the Screen along with a QR code.

- You can add a new UPI ID of your choice. Tap on the right side icon and then select “Add new UPI ID“.

- Enter the new UPI ID of your choice and tap on the Submit button. You can only set the new ID if it is available.

- You can now set any UPI ID as the default ID to receive payments.

Must Read – How to solve BHIM App “UPI registration failed” issue

D] How to find UPI ID in Paytm App?

- Open the Paytm app on your smartphone.

- Log in with the passcode or phone pattern/password.

- Now, swipe from the left to open the menu and tap on the profile icon.

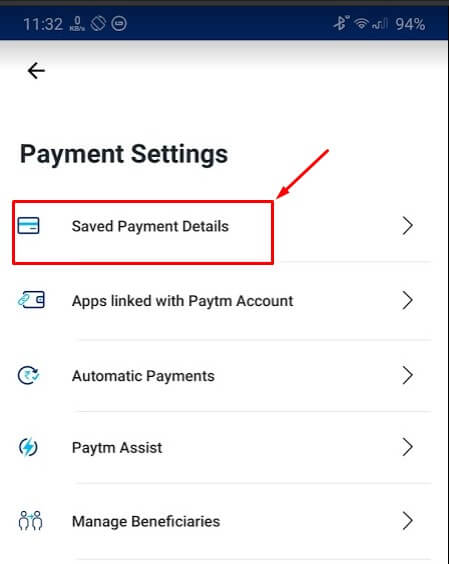

- Tap on the Settings option from the menu.

- On the new page, click on Payments Settings and select the Saved Payment Details option.

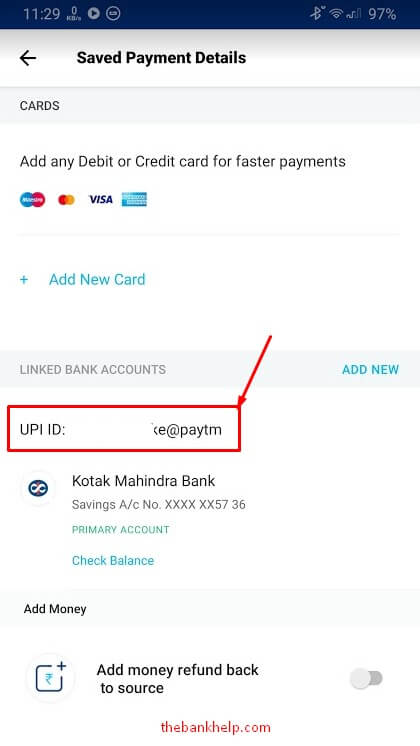

- You can view the UPI ID in Paytm and linked Bank account in the app.

- You cannot create a new UPI ID in Paytm as of now. We will update the article once this facility is available.

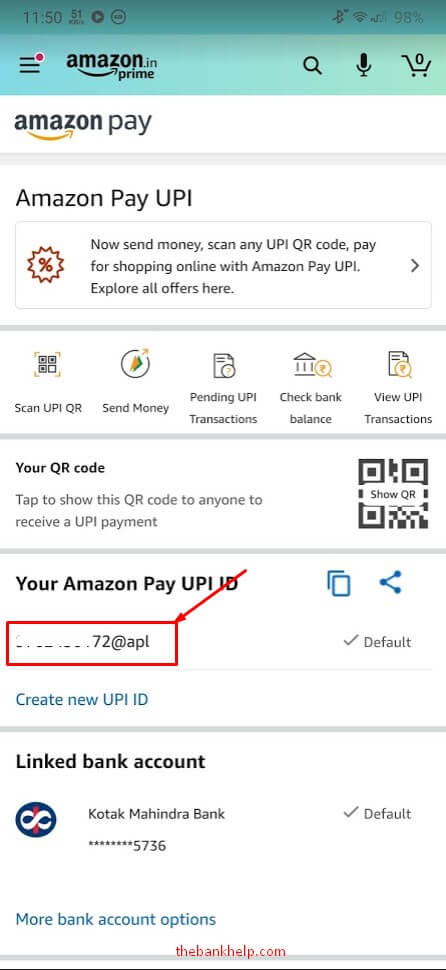

E] How to find UPI ID in Amazon Pay?

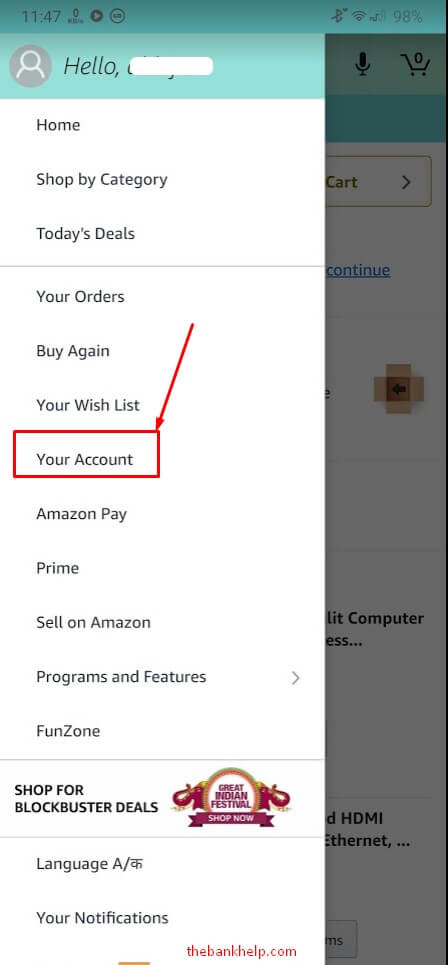

- Open Amazon App and swipe from left to open the menu.

- Tap on the “Your Account” option.

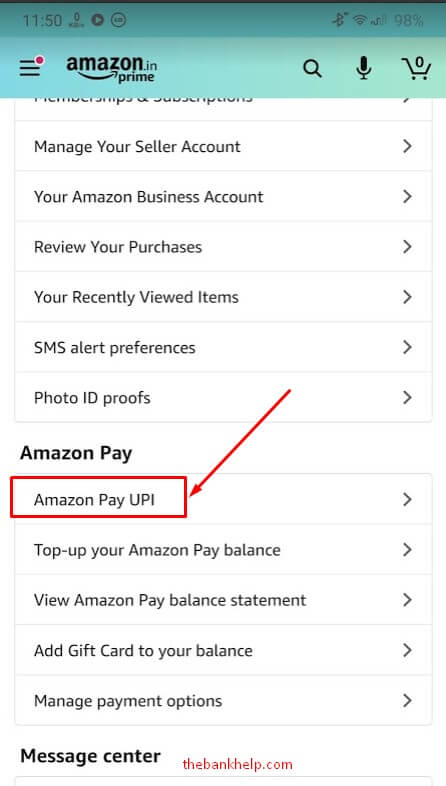

- Under the Amazon Pay section, tap on the “Amazon Pay UPI” option from the new page.

- You can now view the UPI ID in the Amazon app.

- To create a new UPI ID, tap on the “Create New UPI ID” option.

- Enter the UPI ID of your choice on the new screen and click on the Create UPI ID button.

- You can create 3 UPI IDs and set anyone as the default ID for receiving the money.

UPI launched AutoPay features – check if it’s enabled for your Bank

NPCI has launched the functionality of UPI AutoPay for recurring payments. With this new facility introduced under UPI 2.0, customers can now enable recurring e-mandate using any UPI application for recurring payments such as mobile bills, electricity bills, EMI payments, entertainment/OTT subscriptions, insurance, mutual funds among others.If you are BHIM UPI customer, click here. If you are a Merchant, looking to enable UPI AutoPay, click here.